Offshore Trust Services - Questions

Wiki Article

Offshore Trust Services Fundamentals Explained

Table of ContentsThe 9-Minute Rule for Offshore Trust ServicesThe 9-Second Trick For Offshore Trust ServicesOur Offshore Trust Services IdeasThe Main Principles Of Offshore Trust Services An Unbiased View of Offshore Trust Services

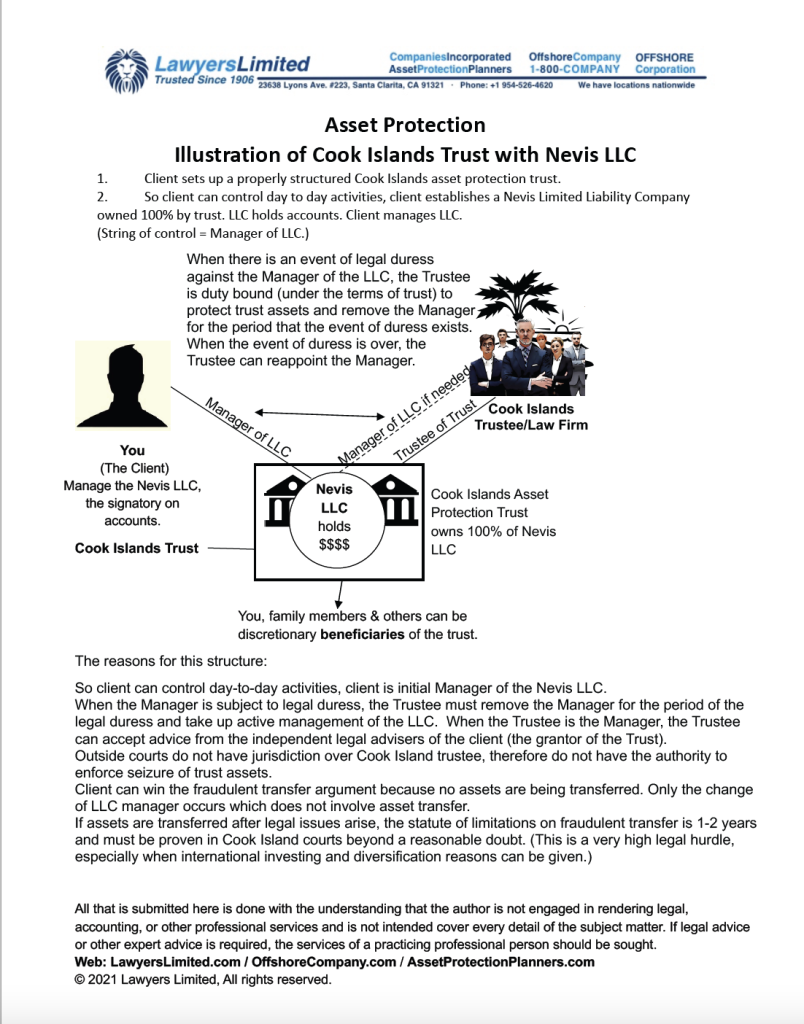

Also if a financial institution can bring a fraudulent transfer case, it is tough to be successful. They must confirm beyond a reasonable uncertainty that the transfer was made with the intent to rip off that particular financial institution as well as that the transfer left the debtor bankrupt. Lots of offshore property security prepares involve greater than one legal entity.

, which for some time has actually been a preferred LLC jurisdiction. Recent adjustments to Nevis tax obligation as well as filing needs have actually led to LLCs in the Cook Islands.

The person might next develop a Chef Islands count on utilizing an overseas count on firm as a trustee. The LLC issues subscription rate of interests to the trustee of the Cook Islands trust fund.

local can function as the preliminary manager of the Nevis LLC with the alternative of selecting an offshore manager must the person ever become under lawful discomfort. With this sort of offshore trust fund structure, the Nevis LLC is managed by the united state person when there are no prepared for legal actions. When a legal concern develops, the trustee of the offshore trust fund should remove the united state

The smart Trick of Offshore Trust Services That Nobody is Discussing

The strategy expands control over 2 separate territories rather than putting all the properties in either the LLC or the trust fund. See to it you fully comprehend the offshore count on structure before moving on with it. An asset defense strategy is much less effective when not recognized by the judgment borrower. Right here are the 5 essential steps to creating an offshore trust fund: Select a territory with favorable offshore trust fund regulations.Give all required records for the trustee's due diligence. Compose the offshore trust paper with your lawyer. Fund the trust by moving domestic properties to the offshore accounts. The very first step to creating an offshore trust fund is choosing a count on territory. offshore trust services. In our experience, the Cook Islands offers the finest mix of trustee guideline, positive debtor legislations, as well as favorable litigation outcomes compared to other jurisdictions.

The trustee firm will certainly use software application to confirm your identity and investigate your present lawful circumstance in the U.S. Count on companies do not desire customers that might entail the company in examinations or lawsuits, such as disputes involving the united state government. You should disclose pending litigation and also investigations as part of the background check.

Everything about Offshore Trust Services

Your residential possession security lawyer will certainly work with the overseas trustee company to compose the offshore trust arrangement. The count on arrangement can be tailored based on your asset security and estate discover here planning goals.

bookkeeping firms, as well as they use the audit results as well as their insurance certificates to potential overseas trust fund clients. The majority of people would love to keep control of their very own properties held pop over to these guys in their offshore trust fund by having the power to eliminate as well as change the trustee. Maintaining the power to change an overseas trustee produces legal risks.

A judge can order the debtor to exercise their maintained legal rights to replace a lender representative for the present offshore trustee. Consequently, overseas count on property defense functions best if the trustmaker has no control over count on possessions or various other parties to the trust fund. The trustmaker must not maintain any powers that they could be required to exercise by an U.S

The 7-Minute Rule for Offshore Trust Services

Some trustee firms allow the trustmaker to reserve primary discretion over trust fund financial investments as well as account monitoring in the position of trust fund advisor. This setup gives the trustmaker some control over possessions conveyed to the depend on, and also the trustmaker can provide up civil liberties if they are intimidated with legal action, leaving the overseas trustee in sole control.The trustmaker does not have direct access to overseas count on financial accounts, yet they can request distributions from the offshore trustee The opportunity of turn over orders and also civil ridicule fees is a substantial risk in offshore asset defense. Debtors relying upon overseas trusts should think about the possibility of a domestic court order to bring back possessions transferred to a borrower's offshore count on.

i thought about this In circumstances when a court orders a debtor to unwind an overseas depend on plan, the debtor can declare that compliance is impossible because the count on is under the control of an overseas trustee. Some current court choices treat a transfer of properties to an offshore depend on as a deliberate act of developing an unfeasibility.

The debtor had actually moved over $7 million to an offshore trustee. The trustee after that transferred the very same cash to a foreign LLC of which the borrower was the single member.

More About Offshore Trust Services

The offshore trustee rejected, as well as he claimed that the cash had been invested in the LLC (offshore trust services). The court held the debtor in contempt of court. The court found that despite the refusal by the offshore trustee, the borrower still had the ability to access the funds as the single member of the LLC.Report this wiki page